As digital transactions increase in popularity, the US is slowly moving away from a physical medium of exchange. With the rise of crypto currency, digital wallets such as Venmo or Apple Pay, and credit cards, many Americans have given up the habit of paying with, or even carrying, physical currency.

Our digital currency age is now set to make its first major break from our analog past, as President Donald Trump signed an executive order on February 9 directing the U.S treasury to stop minting the penny.

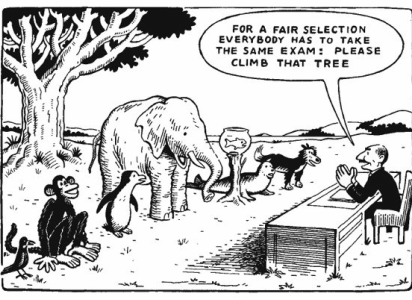

Each penny, famously featuring an intricate imprint of Abraham Lincoln’s profile on its face, and his memorial on the back, costs the U.S. Mint nearly four cents to create — four times the face value of the coin. The difference between the coin’s production cost and the value of the money in the market is referred to as “seigniorage.”

Increased production costs are a primary reason for the increase in the penny’s seigniorage. Copper is expensive, so the U.S. mint has been transitioning from copper to zinc. In fact, the coin has not been made entirely out of copper since 1857.

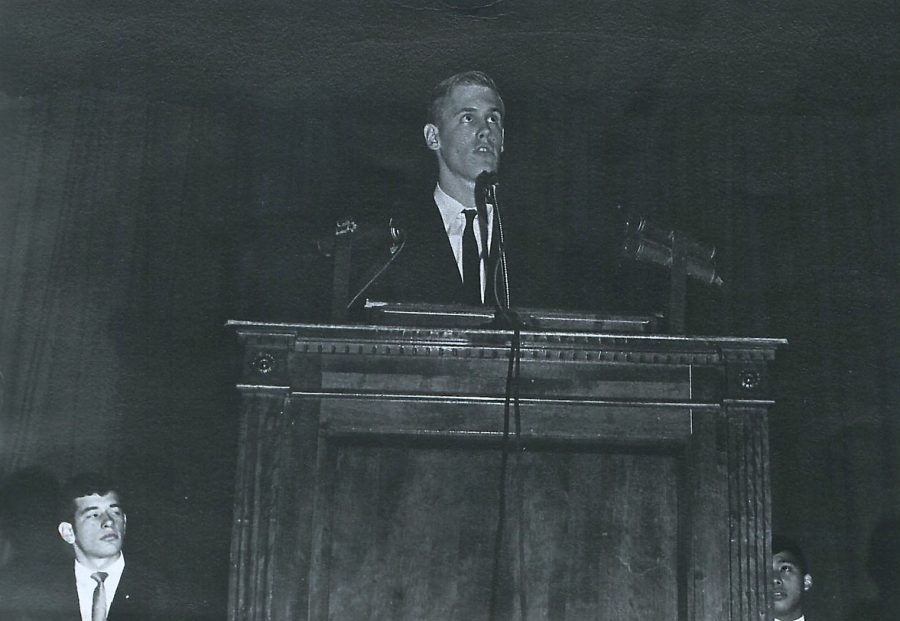

AP Economics teacher Mr. Dave Gilmore explained, “The government is kind of able to use [seigniorage as] leverage in terms of the economy and create more wealth out of that discrepancy. But in terms of pennies, no way.”

Pennies are subject to an increasingly negative seigniorage, as businesses are required to have them in their cash drawers even when the coin fails to stay in circulation, and is becoming more expensive to produce.

“There’s this great need to produce more and more and more because people just take them out of their pocket and put them in a jar,” explained Mr. Gilmore.

Despite the initial shock of the penny’s cancellation, the true effects of its removal should be minor.

“[Prices] will get rounded up [or] rounded down,” Mr. Gilmore noted. “I don’t anticipate any major shock from it.”

Other nations across the globe have gotten rid of their one and two-cent coins with little effect. Estonia is the most recent example, where they have been rounding to the nearest five cents since January 1. Canada and Australia have ceased minting their lowest cent coins as well, due to high seigniorage.

“I’m sure that [the U.S mint] will always be [minting coins], but their role in circulation [will] become less and less,” added Mr. Gilmore.

The penny is not the only coin the U.S has phased out. The half cent coin was discontinued under the Coinage Act of 1857 due to rising inflation, decreased necessity, and the increasing price of copper.

The cancellation of the penny is only the tip of the currency iceberg as financial systems face the rapid expansion of digital currency.

“Central banks that manage the money supply are experimenting with producing a digital currency, like a digital dollar,” Mr. Gilmore noted.

A digital dollar is considered a fiat currency, backed not by a physical commodity such as gold, but by the government’s assigned value and the public’s trust.

Crypto, although similar to digital currency in its lack of a tangible form, is seen as a reaction to fiat currency because it is independent, not requiring government regulation or backing and receiving its value through supply and demand. As Mr. Gilmore noted, “Crypto believers feel it is based on nothing other than people’s willingness to use it.”

On March 6, Trump signed an executive order to create a strategic Bitcoin reserve, which legitimizes Bitcoin, the first crypto currency, as a reserve asset – government assets that can be quickly converted into cash to use to either support the national currency or for payments – in the U.S treasury. Federal backing for Bitcoin would seem to compromise the market appeal of crypto’s independence, but it also validates the currency at the same time. In the same executive order, Trump authorized the creation of a Digital Asset Stockpile. These digital assets are essentially all cryptocurrencies held by the U.S government that have been forfeited during criminal proceedings, except Bitcoin due to the creation of the strategic Bitcoin reserve.

The effect of these actions is unclear, but Mr. Gilmore expressed caution, stating, “I think [the government backing crypto currency] has got problems all over it, the minute it collapses, that’s our tax dollars.”

According to Mr. Gilmore, messing with a “multi-trillion dollar a year economy,” is dangerous, especially one as volatile as crypto.

“The reality is that [vulnerability for deception is] what modern financing is, and crypto is just not delivering on major benchmarks for what would make it a currency,” he explained. “It’s not widely accepted, it’s not a medium of exchange, it doesn’t [have] the store of value.”

With government focus on digital transactions now growing, the economy seems increasingly less reliant on physical means of exchange.

The influence of crypto currency is currently quite prominent in the executive branch, from President Trump launching his own Trump meme coin just days before his inauguration to Elon Musk, one of Dogecoin’s main backers, overseeing the Department of Government Efficiency (DOGE). The literal connection between Dogecoin and DOGE seems a not-so-subtle attempt by Musk to stir controversy.

“Commerce and the functionality of digital transactions [has] already taken over to a large extent, but will ultimately push notes and coins to the periphery of doing business,” Mr. Gilmore concluded.