Tech Seniors Speak on the Financial Aid Process

Having received all of their college results, many Tech seniors still struggled to make a decision on which college to attend. Among all the factors to consider, cost is often the most pressing.

In the past year alone, tuition and fees at private universities have jumped 134%, out-of-state tuition at public national universities has risen 141%, and in-state tuition and fees at public national universities have grown a staggering 175%. A survey consisting of 200 Brooklyn Tech seniors found that approximately 87% are worried about how to cover college costs due to the tuition hikes seen as a result of inflation, state funding cuts, and expanding administrative staff.

Cost is often the deciding factor when students commit to a college.“What I took into account was the cost mainly and the location,” explained Leo Chen (‘23). “Let’s take the University of Buffalo and Binghamton for example. I got into both, but I plan on going to Binghamton since it’s closer to home and their financial aid is better.”

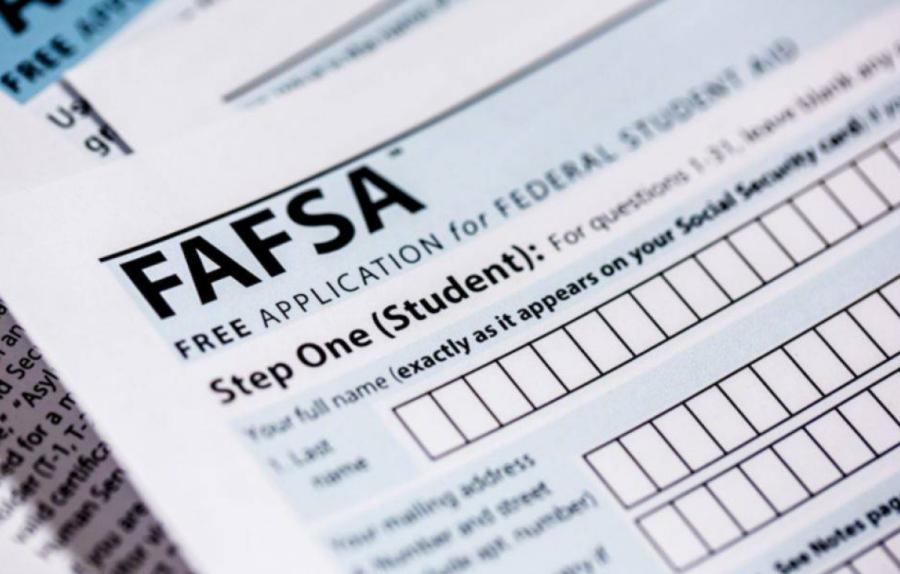

Nationally, about 57% of high school seniors fill out a Free Application for Federal Student Aid (FAFSA) form, seeking assistance from the federal government to help cover the costs of college. The process can be complicated and frustrating, and often nets little aid. The maximum amount of aid granted in 2023 was $6,895.

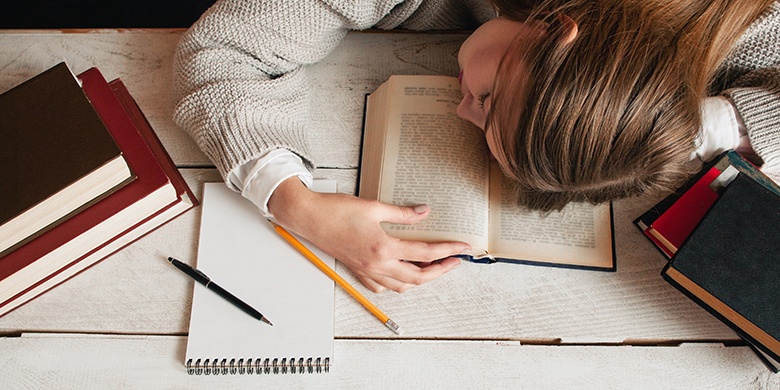

“I would say applying for financial aid was probably one of the most stressful parts of the application process,” noted Agatta Castro (‘23), who received a considerable amount of financial aid. “So many schools ask for so many documents, and if you mess up on one you have to do it all over again which is very annoying.”

Of the student population at Tech, 61% are economically disadvantaged, representing the minimum amount of the student population who require financial aid. Even students who come from middle-income, and in some cases, upper-middle income families, are affected by the rising costs in college tuition.

According to the Education Data Initiative, four-year public colleges cost an average of $27,279 per year, and private colleges cost an average of $54,501 per year. Due to this, middle-income families may have financial troubles if their students attend private universities, at which costs can even soar above $70,000 annually.

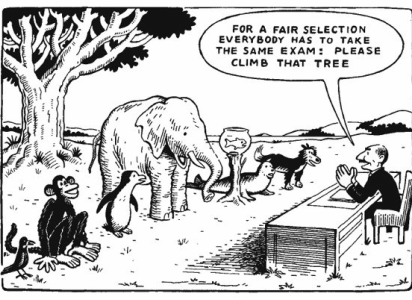

Erick Palanker (‘23) will be attending Cornell University in the fall, a school which he was fortunately able to choose on its merits, not its price tag. “If I’m being honest, I’m not expecting any aid because my parents agreed to cover my tuition and I’m very thankful for it,” Palanker said. “My understanding of financial aid, which has only come from what I’ve seen happen to others, is that the financial aid programs consider all of your assets, yearly salary, current loans and mortgages, and more. A lot of kids ended up having little to no financial aid with parents who are making $80,000 to $100,000 a year, while a full-price school is like $75,000.”

“It makes sense why they consider everyone’s assets,” Palanker added. “But so many kids end up having to withdraw their applications, with some not even applying to these top schools simply because they have no chance at affording it at all.”

In spite of this, many students choose to apply to top, expensive schools in the hope of receiving merit scholarships and financial aid. This year, about 44% of the senior class applied to Cornell University, 30% applied to Columbia University, and 22% applied to University of Pennsylvania. Other top colleges with high tuitions such as New York University and Northeastern University were applied to by around 55% and 37% of the senior class, respectively.

The process of receiving aid can be as unpredictable as it is stressful. One anonymous senior shared her frustrations with the financial aid process that cost her an acceptance to her dream school.

“I applied Early Decision to Boston University, and I got in,” she explained. “They planned to make me pay approximately $45,000 and my financial aid package had a scholarship as well as a work-study loan. So if you don’t count the loan, it was $50,000 a year. I appealed and they gave me $4,000 more in aid, bringing [the tuition] back down to $45,000 since that amount covered the loan, which I didn’t want to take. I ended up withdrawing because they wouldn’t give me an extension to get new tax forms.”

Due to the price of highly ranked schools, many seniors opt to apply to scholarship programs, such as CUNY’s Macaulay Honors, a program that allows students to study at any one of NYC’s eight CUNYs with their tuition fully paid. Macaulay recipients, such as Alexandra Shatan (‘23), are also granted $7,500 to go towards any academic pursuit, priority enrollment to classes, a free MacBook, academic advisors, and exclusive seminars that only Macaulay students are allowed to take.

“The process was relatively straightforward,” Shatan explained. “You apply through the CUNY application, but basically just select the Macaulay option for one college and submit the common app and a ‘why us.’ Depending on the school, you might get called for an interview as well.”

Shatan is very relieved that she was accepted into the Macaulay Honors program. “Initially I was hesitant to apply to Macaulay because of the stigma surrounding attending a CUNY, especially in a school like Tech where the end goal is essentially an Ivy or top 20,” Shatan admitted.

Janet Gao (‘23) agreed that there is a stigma attached to going to a more affordable school and claims that there is a cache attached to receiving scholarships to prestigious universities, which are often much more expensive than average. “People want to be able to afford the schools that they are going to, and most people believe that the easy way to get by with a low tuition is to attend a less-known school or community college,” Gao said. “To attend a really high-ranked school free of charge, either through Questbridge, other aid programs, or aid coming from the college itself, is the best case scenario, so, of course, a lot of people would prefer that.”

Gao added, “However, I’ve come to realize that graduating without debt and reviewing a top-tier education can coexist. At Macaulay, I’ll be taught by graduates from prestigious schools and be surrounded by passionate students while being absolved of the burden of having to repay student loans.”

Seniors encouraged sophomores and juniors who plan to apply for financial aid to check out the Macaulay Honors program, start FAFSA early, and make sure to apply for scholarships in order to receive grants in the future. One way to find scholarships is through the scholarship newsletter sent out by the school’s scholarship coordinators, but opportunities can also be found through the Scholarship Search page on Naviance.

Ms. Akua Aboagye, a college counselor at Tech, said, “Financial aid grants from the government are predetermined by W-2s and the parent’s income so the college office assures rising juniors and sophomores to search for scholarships and apply for aid from their college. Start having open conversations with parents about financials from now. Whether your parents are divorced or separated does make a difference. The financial aid process is predetermined so you just need to make sure you have all of your accounts in order.”

Castro insisted, “I would tell everyone to get started on their financial aid early. You get more money back and you get it done at the beginning of the process!”

Leah Badawi (she/her) is a staff writer for Features. Leah reveres the importance of journalism because...

Hua • Oct 29, 2023 at 3:12 pm

thank you for sharing this piece. I found it super informative as a senior parent!